BLOG DETAILS Share this Image On Your Site <p><strong>Please include...

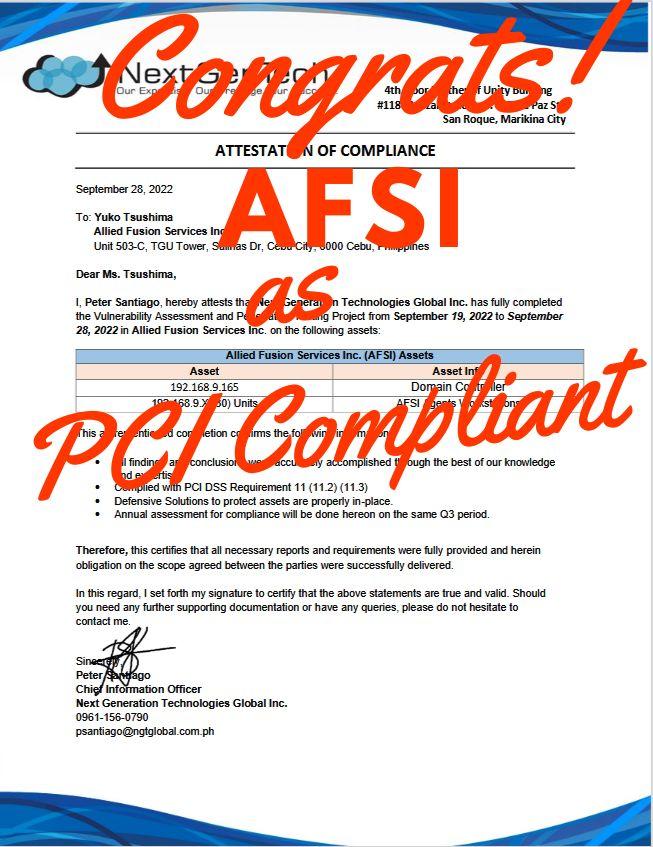

Read MoreAllied Fusion Services, Inc as PCI Compliant

Recently, Allied Fusion Services Inc. completed the AOC (Attestation of Compliance) which is the declaration of an organisation’s compliance with Payment Card Industry Data Security Standard (PCI DSS).

Becoming PCI compliant is an achievement as we assure and protect our client`s costumers` payment security.

What Is Attestation of Compliance (AoC) and Why Is It Important?

Attestation of Compliance (AoC) is a declaration of an organization’s compliance with PCI DSS.

The Payment Card Industry Data Security Standard (PCI DSS) is a security standard established by major card brands to help organizations that process, store, or transmit card data maintain secure payment environments and protect cardholder data.

It does matter and is important because it proves that a business is PCI compliant and is following best practices to maintain secure payment environments and protect cardholder data.

If a business is not compliant, this will put at risk to the organization and their customers’ sensitive payment information. In addition, failure to achieve compliance increases an organization’s risk of cyberattacks, which directly impact customers. It reduces the risk of credit and debit card data loss. Once a business gets hit by a breach, this can possibly harm thousands to millions of customers by exposing card payment details stored on an organization’s internal environment.

Not only is PCI compliance a requirement for businesses to prevent identity theft, but it is also packed full of best practices for detecting, preventing, and remediating data breaches.

Reach out to us anytime!

TALK TO USRelated Links:

Is outsourcing good or bad?

FAQ DETAILS Outsourcing is neither inherently good nor bad—it depends...

Read MoreCommon Mistakes to Avoid When Outsourcing Web Development Projects

BLOG DETAILS Outsourcing web development can be a game-changer for...

Read More